Available nationwide, the MutualOne Bank Mo Premium Savings account offers 4.07 APY on balances of $20,000 or more. MutualOne Bank Mo Premium Savings Review MutualOne Bank is headquartered in Framingham and is the 46th largest bank in the state of Massachusetts. It is also the 928th largest bank in the nation. It was established in… [Continue Reading]

Lafayette Federal Credit Union Preferred Savings Review: 3.80% APY (Nationwide)

Available nationwide, Lafayette Federal Credit Union Preferred Savings is offering up to 3.80% APY on your funds. Lafayette Federal Credit Union Preferred Savings Review Lafayette Federal Credit Union is headquartered in Rockville and is the 6th largest credit union in the state of Maryland. It is also the 283rd largest credit union in the nation…. [Continue Reading]

Best Reward Checking Accounts 2025

Are you looking for checking accounts that will let your money earn rewards for you? If so then you should look into Rewards Checking Accounts (RCA). These Reward Checking Accounts is a great checking account option where if you meet certain requirements you’ll be able to receive a higher than average APR compared to a… [Continue Reading]

Best Money Market Accounts 2025

A money market account is a savings account that offers a higher interest rate than a traditional savings account but may require larger minimum deposits and balances. Similar to savings accounts, money market accounts have specific rules with a limited number of monthly transactions on the withdrawals from the account. If you need more than… [Continue Reading]

Origin Bank Performance Checking Account Review: 6.00% APY Up To $40,000 (Louisiana, Mississippi, Texas)

Origin Bank is currently offering residents of Louisiana, Mississippi, and Texas a generous 6.00% APY when you sign up and open a new Performance Checking account for a limited time. If you are currently interested, the bank is offering you the attractive APY rate on balances up to $60,000. To qualify, all you would need… [Continue Reading]

Bethpage Federal Credit Union Money Market Review: 2.00% APY Rate (Nationwide)

Available nationwide, Bethpage Federal Credit Union Money Market is offering a 2.00% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Bethpage Federal Credit Union Money Market Review Bethpage Federal Credit Union is a federally chartered credit union headquartered in Bethpage, Long Island, New York. I’ll review… [Continue Reading]

Zynlo Bank Tomorrow Savings Review: 3.52% APY (Nationwide)

Zynlo Bank offers 3.52% APY Rate or more when you open your Today Spending and Tomorrow Savings accounts. This offer is available nationwide except for: MA, CT, NY and CA. Read below for more information on what their account has to offer. Zynlo Bank Tomorrow Savings Review With Zynlo Bank, it’s an all digital bank… [Continue Reading]

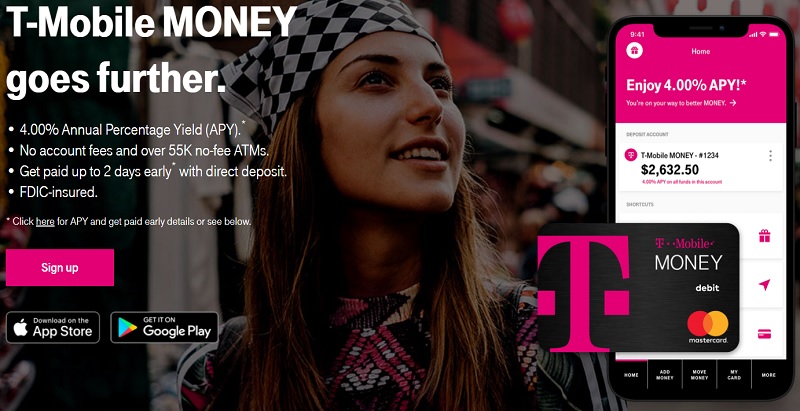

T-Mobile Money Checking Review: 4.00% APY Up To $3K, 2.50% For All Balances (Nationwide)

Available nationwide, T-Mobile Money is offering 4.00% APY on their Checking Account. Keep reading to learn all you need to know about the attractive rate and account. Everyone earns 2.50% APY on all balances. T-Mobile Money Checking Review T-Mobile Money goes further with banking and get started in minutes. They offer a variety of accounts and… [Continue Reading]

Varo Money Savings Review: 3.00% Up to 5.00% APY (Nationwide)

Available nationwide, Varo Money Savings is offering a 3.00% APY up to 5.00% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate! Varo Money Savings Review Varo is an all-mobile bank account built with best-in-class technology to help people get ahead financially. In addition to an… [Continue Reading]

Northpointe Bank Ultimate Savings Review: 3.25% APY (Nationwide)

Available nationwide, the Northpointe Bank Ultimate Savings Account offers a generous 3.25% APY with an opening deposit of any amount. Northpointe Bank’s Ultimate Savings Account offers a competitive rate without the monthly fees that other banks may charge. Northpointe Bank Ultimate Savings Account Review Northpointe Bank is headquartered in Grand Rapids, Michigan and was founded in… [Continue Reading]

Northpointe Bank Ultimate Money Market Review: 3.25% APY Rate (Nationwide)

Available to residents nationwide, Northpointe Bank is offering 3.25% APY when you open a new Ultimate Money Market Account with a opening deposit of any amount. Northpointe Bank Ultimate Money Market Account Review Northpointe Bank is headquartered in Grand Rapids, Michigan and was founded in 1999. Today, there are more than 800 employees strong and… [Continue Reading]

Neighbors Bank High Yield Online Savings Review: 2.91% APY (Nationwide)

Available nationwide, Neighbors Bank is now offering a 2.91% APY Rate for their High Yield Online Savings Account. Read below for more information on their appealing rates and accounts below. Editor’s Note: They’re not currently accepting new online savings accounts. Neighbors Bank High Yield Online Savings Review With Neighbors Bank, they are mainly focused on… [Continue Reading]

CIT Bank Savings Builder Review: 1.00% APY (Nationwide)

Take advantage of the current CIT Bank Savings Builder bonuses, promotions, and offers here. Learn more on how to earn your CIT Bank Savings Builder Bonus. Available to residents nationwide, CIT Bank is offering up to 1.00% APY when you open a new Savings Builder Account with a opening deposit of $100. For complete list of account… [Continue Reading]

Premier America Credit Union Business Money Market Review: Up to 1.10% APY (Nationwide)

Available nationwide, the Premier America Credit Union Business Money Market account is offering up to 1.10% APY on your funds. Premier America Credit Union Business Money Market Review Premier America Credit Union is headquartered in Chatsworth and is the 22nd largest credit union in the state of California. It is also the 121st largest credit… [Continue Reading]

Greenwood Credit Union Business Money Market Review: Up to 1.25% APY (Nationwide)

Available nationwide, the Greenwood Credit Union Business Money Market account is offering up to 1.25% APY on your funds. Greenwood Credit Union Business Money Market Review Greenwood Credit Union is headquartered in Warwick and is the 3rd largest credit union in the state of Rhode Island. It is also the 543rd largest credit union in… [Continue Reading]

Signature Federal Credit Union Business Money Market Review: Up to 1.00% APY (Nationwide)

Available nationwide, the Signature Federal Credit Union Business Money Market account is offering up to 1.00% APY on your funds. Signature Federal Credit Union Business Money Market Review Signature Federal Credit Union is headquartered in Alexandria and is the 29th largest credit union in the state of Virginia. It is also the 863rd largest credit… [Continue Reading]

Nationwide My Checking Review: Get Paid Up to Two Days Early + Get Unlimited Domestic ATM Fee Reimbursements

Available nationwide, the Nationwide My Checking account that allows you to get paid up to two days earlier and also comes with unlimited domestic ATM Fee Reimbursements. Continue reading to learn all about this account and it’s features. Nationwide My Checking Review Axos Bank is a financial institution built on providing their clients with a diverse… [Continue Reading]

Nationwide Direct Checking Review: Get Paid Up to Two Days Early

Available nationwide, check out the Nationwide Direct Checking account and get paid up to two days early. Be sure to keep reading to learn more about the account and all the features that come with it. Nationwide Direct Checking Review Axos Bank provides a diverse and constantly growing range of banking products and services for personal,… [Continue Reading]

Axos Bank Essential Checking Account Review: America’s Most Experienced Online Bank

Axos Bank is an internet-online bank that offers superior customer service and financial products through their Essential Checking Account. This bank is a technology-driven financial service company that offers a diverse range of innovative banking products and services for personal, business, and institutional clients nationwide. Additionally, customers are able to take advantage of free online banking… [Continue Reading]

The Federal Savings Bank Online Money Market Review: 2.50% APY (Nationwide)

Available nationwide, The Federal Savings Bank Online Money Market account is offering a 2.50% APY on your funds. The Federal Savings Bank Online Money Market Review The Federal Savings Bank is headquartered in Chicago and is the 69th largest bank in the state of Illinois. It is also the 1,262nd largest bank in the nation. It was… [Continue Reading]

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 56

- Next Page »