Here you will find the latest Regions Bank bonuses, promotions and offers to take advantage of.

Update 1/14/25: There is now a $400 checking bonus offer available through 3/31/25. The $300 checking bonus is back through 6/30/25.

Regions Bank Bonuses Review

Regions Bank is the banking division of Regions Financial Corporation, which is one of the largest financial service providers in the United States. Headquartered in Birmingham, Alabama, it is the largest bank in the state and one of the largest banks in the southeastern United States. Regions Bank operates over a thousand branches across multiple states.

I’ll review the current Regions Bank bonuses below.

Regions Bank $400 Checking Bonus

Regions Bank is offering a $400 bonus when you open a new checking account and meet eligible requirements.

- What you’ll get: $400 bonus

- Eligible account: LifeGreen Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Branch Locator)

- Credit Inquiry: Soft Pull

- Direct Deposit Required: Yes

- Monthly Fees: $0-$18

- How to earn it:

- First, you must register for your offer in the form. You must register by March 31, 2025. You will receive a registration confirmation email with your next steps to earn your offer.

- Open a new personal LifeGreen Preferred Checking® account by May 1, 2025. Open your account online or visit your local branch to open your account in person.

- Enroll in Online Banking within 90 days of opening your account.

- Make $1,000 or more of qualifying ACH direct deposits to your new LifeGreen Preferred Checking® account that must post within 90 days of account opening. Deposits must be new to Regions.

(Offer expires 03/31/2025)

| Chase Private Client ($3,000 Bonus) | Fifth Third Preferred Checking ($300 Bonus) |

| KeyBank Checking ($300 bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

Fine Print

- Offer only applies to personal LifeGreen checking accounts.

- Offer expires April 1, 2025.

- However, offer may be discontinued or changed at any time prior to the expiration date without notice.

- Email address used when opening your checking account must match the email address used when registering.

- We reserve the right to terminate this offer without notice at any time in the event of any suspected or actual abuse or fraud.

- Offer valid in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, and Texas.

- This offer is nontransferable, may not be combined with any other offer, and does not apply if you have or had an ownership interest in a personal Regions checking account on or after January 1, 2024, and may be withdrawn at any time without notice.

- When the credit is issued, new account must be open and have a positive balance.

- Enrolling in Online Banking requires a Social Security or Taxpayer ID number (alternative options may be available by visiting a branch).

- Regions may report bonus value to the IRS as required by law, and customer is responsible for any tax due on any amount received under this offer.

- Anyone without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien), or who has been notified they are subject to backup withholding, or non-resident aliens signing Form W-8 are not eligible for the offer.

- Regions associates are not eligible.

- Deposit Accounts: All LifeGreen checking accounts require a $50 minimum opening deposit.

- As of January 1, 2025, the Annual Percentage Yield (APY) paid on LifeGreen Preferred Checking® accounts was 0.01% for all balances.

- Regions may change the APY at any time.

- Check the current interest rates and APYs for LifeGreen Savings and LifeGreen Preferred Checking.

- No interest is paid on other personal checking accounts.

- Fees may reduce earnings.

- Accounts opened in Iowa may be subject to a 6% Iowa State Tax.

Regions Bank $300 Checking Bonus

Regions Bank is offering a $300 bonus when you open a new checking account and meet eligible requirements.

- What you’ll get: $300 bonus

- Eligible account: LifeGreen Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Branch Locator)

- Credit Inquiry: Soft Pull

- Direct Deposit Required: Yes

- Monthly Fees: $0-$18

- How to earn it:

- First, you must register for your offer in the form. You must register by June 30, 2025. You will receive a registration confirmation email with your next steps to earn your offer.

- Open a new personal LifeGreen® checking account by July 31, 2025. Open your account online or visit your local branch to open your account in person.

- Enroll in Online Banking within 90 days of opening your account.

- Make $1,000 or more of qualifying ACH direct deposits to your new LifeGreen checking account that must post within 90 days of account opening. Deposits must be new to Regions.

- Your bonus will be deposited directly to your new checking account within 60 days of completing the above requirements.

(Offer expires 06/30/2025)

| Chase Total Checking ($300 Bonus) | KeyBank Checking ($300 bonus) |

| Bank of America Checking ($300 Bonus Offer) | SoFi Checking & Savings Account ($325 bonus) |

Fine Print

- Offer only applies to personal LifeGreen checking accounts.

- Offer expires July 1, 2025.

- However, offer may be discontinued or changed at any time prior to the expiration date without notice.

- Email address used when opening your checking account must match the email address used when registering.

- We reserve the right to terminate this offer without notice at any time in the event of any suspected or actual abuse or fraud.

- Offer valid in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, and Texas.

- This offer is nontransferable, may not be combined with any other offer, and does not apply if you have or had an ownership interest in a personal Regions checking account on or after January 1, 2024, and may be withdrawn at any time without notice.

- When the credit is issued, new account must be open and have a positive balance.

- Enrolling in Online Banking requires a Social Security or Taxpayer ID number (alternative options may be available by visiting a branch).

- Online Banking is subject to separate terms and conditions.

- Regions may report bonus value to the IRS as required by law, and customer is responsible for any tax due on any amount received under this offer.

- Anyone without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien), or who has been notified they are subject to backup withholding, or non-resident aliens signing Form W-8 are not eligible for the offer. Regions associates are not eligible.

- Deposit Accounts: All LifeGreen checking accounts require a $50 minimum opening deposit. As of January 1, 2025, the Annual Percentage Yield (APY) paid on LifeGreen Preferred Checking® accounts was 0.01% for all balances.

- Regions may change the APY at any time.

- Check the current interest rates and APYs for LifeGreen Savings and LifeGreen Preferred Checking.

- No interest is paid on other personal checking accounts. Fees may reduce earnings.

- Accounts opened in Iowa may be subject to a 6% Iowa State Tax.

Regions Bank $400 Checking Bonus (In-Branch)

Regions Bank is offering up to a $400 bonus when you open a new checking account and meet eligible requirements.

- What you’ll get: $400 bonus

- Eligible account: LifeGreen Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Branch Locator)

- Credit Inquiry: Soft Pull

- Direct Deposit Required: No

- Monthly Fees: $0-$18

- How to earn it:

- Open a new personal LifeGreen checking account in-branch.

- Enroll in Online Banking within 30 days of opening your account.

- Make $1,000 in total deposits that post to your account within 30 days of account opening. Deposits must be new to Regions.

Editor’s Note: No direct link to the offer, however, it has been reported that the $400 bonus is being offer in-branch. YMMV.

| Chase Total Checking ($300 Bonus) | KeyBank Checking ($300 bonus) |

| Bank of America Checking ($300 Bonus Offer) | SoFi Checking & Savings Account ($325 bonus) |

Fine Print

- Register before or at the time you open your checking account to be eligible.

- Present the personalized voucher emailed after registration was completed with your name and registered email address.

- To open online: You must enter the promo code at the time you open your account online to be eligible for this offer.

- General: Offer only applies to personal LifeGreen checking accounts.

- Email address used when opening your checking account must match the email address used when registering.

- We reserve the right to terminate this offer without notice at any time in the event of any suspected or actual abuse or fraud.

- Offer valid in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, and Texas.

- This offer is nontransferable, may not be combined with any other offer, and does not apply if you have or had an ownership interest in a personal Regions checking account on or after July 1, 2021, and may be withdrawn at any time without notice.

- When the credit is issued, new account must be open and have a positive balance.

- Enrolling in Online Banking requires a Social Security or Taxpayer ID number (alternative options may be available by visiting a branch).

- Total deposits may be combined to exceed $500, must post to your new account within 60 days of account opening, must be new funds to Regions, and may not be transferred from other existing Regions accounts.

- Regions may report bonus value to the IRS as required by law; anyone whose tax status would require Regions to impose tax withholding is not eligible.

- Regions associates are not eligible. Deposit Accounts: All LifeGreen checking accounts require a $50 minimum opening deposit.

- As of July 1, 2022, the Annual Percentage Yield (APY) paid on LifeGreen Preferred Checking® accounts was 0.01% for all balances.

- Regions may change the APY at any time.

- No interest is paid on other personal checking accounts.

- Fees may reduce earnings.

- Accounts opened in Iowa may be subject to a 6% Iowa State Tax.

Regions Bank $150 Business Checking Bonus

Regions Bank is offering a $150 bonus when you open a new eligible business checking account and meet certain requirements.

Referred business must open a new Regions business checking account within 90 days of receiving the invite. Opening deposit should be $500 or more. Within 60 days of account opening, complete at least one Visa Business CheckCard purchase that posts to the new account, and enroll in Online Statements through Regions Online Banking.

To request for a $150 business checking bonus, send an email to [email protected] and title your email “Regions Bank Referral Bonus”

- What you’ll get: $150 bonus

- Eligible account: Business Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Branch Locator)

- Credit Inquiry: Soft Pull

- Direct Deposit Required: No

- Monthly Fees: $7-$25

- How to earn it:

- Open a new personal LifeGreen checking account by September 30, 2022. Get started by opening an account online with promo code RGSUMR22, or register and present your personalized email voucher when you open your account at your local branch.

- Enroll in Online Banking within 60 days of opening your account.

- Make $500 in total deposits that post to your account within 60 days of account opening. Deposits must be new to Regions.

- Your bonus will be deposited directly to your new checking account within 90 days of completing the above requirements.

- To open in-branch: Register before or at the time you open your checking account to be eligible. Present the personalized voucher emailed after registration was completed with your name and registered email address.

- To open online: You must enter the promo code at the time you open your account online to be eligible for this offer.

To receive the offer, you MUST request the offer via email.*

| Chase Business Checking ($300 or $500 Bonus) | Axos Business Premium Savings ($375 Bonus) |

| Axos Bank Basic Business Checking ($400 Bonus) | Axos Bank Business Interest Checking ($400 Bonus) |

| Huntington Unlimited Plus Business Checking ($1,000 Bonus) | Huntington Unlimited Business Checking ($400 Bonus) |

| Bluevine Business Checking ($300 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

Fine Print

- Register before or at the time you open your checking account to be eligible.

- Present the personalized voucher emailed after registration was completed with your name and registered email address.

- To open online: You must enter the promo code at the time you open your account online to be eligible for this offer.

- General: Offer only applies to personal LifeGreen checking accounts.

- Email address used when opening your checking account must match the email address used when registering.

- We reserve the right to terminate this offer without notice at any time in the event of any suspected or actual abuse or fraud. Offer valid in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, and Texas.

- This offer is nontransferable, may not be combined with any other offer, and does not apply if you have or had an ownership interest in a personal Regions checking account on or after July 1, 2021, and may be withdrawn at any time without notice

Regions Bank $50/$150 Referral Bonuses

Here is more detail on the $50/$150 referral bonus stated above. If you would like a referral link, follow the steps below.

- What you’ll get: $50/$150

- Eligible account: LifeGreen Checking, Business Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Branch Locator)

- Credit Inquiry: Soft Pull

- Direct Deposit Required: No

- Monthly Fees: $0-$18

- How to earn it:

- $50 Personal Checking referral. Referred person must:

- Within 90 days of receiving the referral:

- Register for the program (using the referral email or in a branch); and

- Open a new Regions personal LifeGreen® checking account.

- Within 60 days of opening the new account:

- Make at least ten Regions Visa® CheckCard purchases that post to the new account;

- Have at least one $300 or more ACH direct deposit (such as a reoccurring payroll or government benefit deposit) post to the new account; and

- Enroll in Online Statements through Regions Online Banking.

- Within 90 days of receiving the referral:

- $150 Business Checking referral. Referred person must:

- Within 90 days of receiving the referral:

- Register for the program (using the referral email or in a branch);

- Open a new Regions business checking account and deposit at least $500 the day the account is opened.

- Within 60 days of opening the new account:

- Make at least one Visa Business CheckCard purchase that posts to the new account; and

- Enroll in Online Statements through Regions Online Banking.

- Within 90 days of receiving the referral:

- $50 Personal Checking referral. Referred person must:

(Offer has no expiration date)

| Chase Private Client ($3,000 Bonus) | Fifth Third Preferred Checking ($300 Bonus) |

| KeyBank Checking ($300 bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

Fine Print

- All checking accounts are subject to the Regions Deposit Agreement.

- All personal LifeGreen checking accounts require a $25 minimum opening deposit.

- Taxes are the responsibility of the recipient.

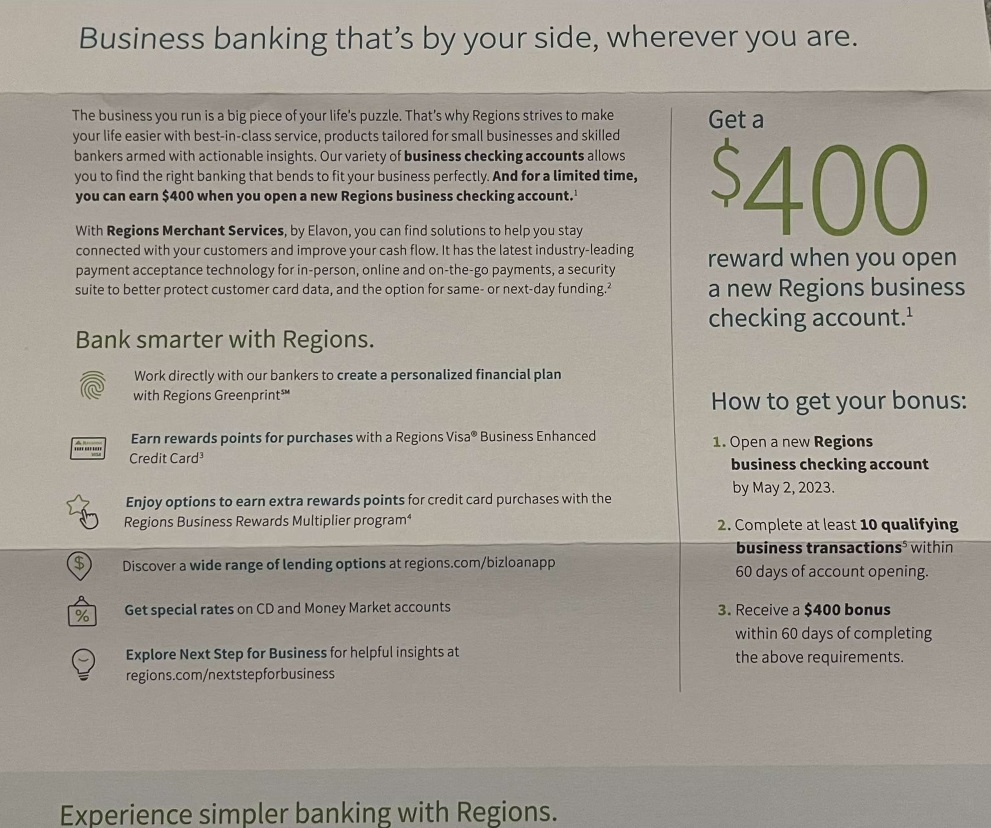

Regions Bank $400 Business Checking Bonus (Targeted)

Regions Bank is offering a,$400 bonus when you open a new business checking account and meet eligible requirements.

- What you’ll get: $400 bonus

- Eligible account: Business Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX

- Credit Inquiry: Soft Pull

- Direct Deposit Required: No

- Monthly Fees: $7-$25

- How to earn it:

- Open a new Regions business checking account by May 2, 2023.

- Complete at least 10 qualifying business transactions within 60 days of account opening.

- Receive a $400 bonus within 60 days of completing the above requirements.

Editor’s Note: No direct link to offer. Check your mail for this offer.

| Chase Business Checking ($300 or $500 Bonus) | Axos Business Premium Savings ($375 Bonus) |

| Axos Bank Basic Business Checking ($400 Bonus) | Axos Bank Business Interest Checking ($400 Bonus) |

| Huntington Unlimited Plus Business Checking ($1,000 Bonus) | Huntington Unlimited Business Checking ($400 Bonus) |

| Bluevine Business Checking ($300 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

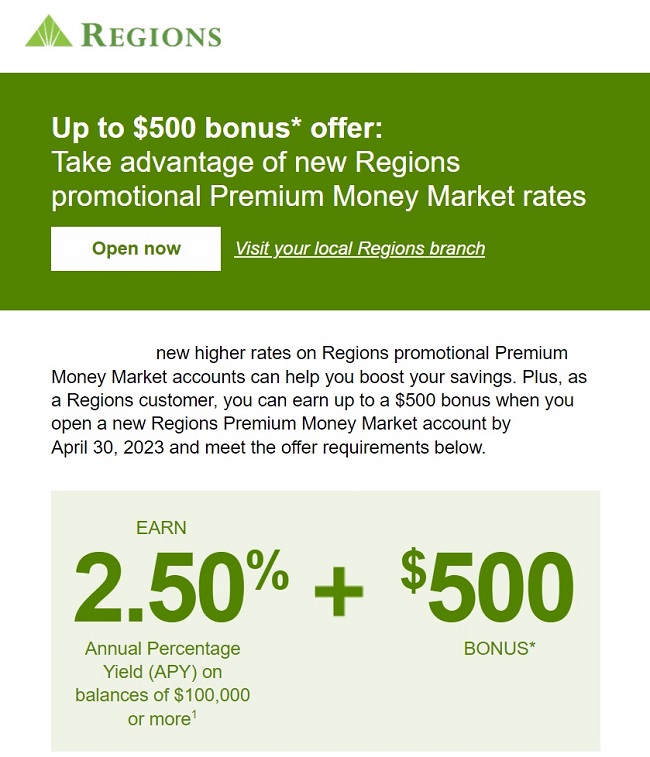

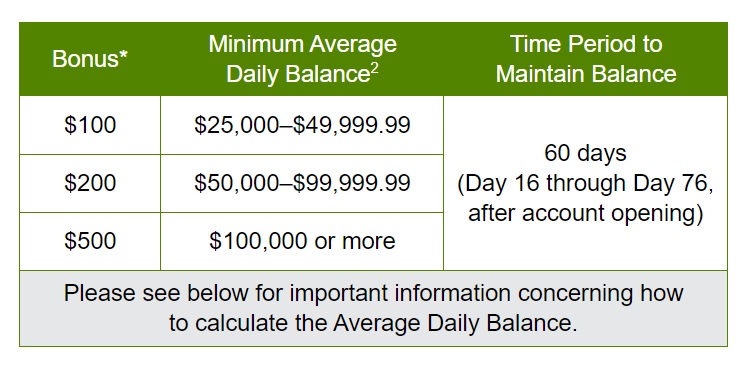

Regions Bank $500 Money Market Bonus (Targeted) (Expired)

Regions Bank is offering up to a $500 bonus when you open a new money market account and meet eligible requirements.

- What you’ll get: Up to $500 bonus

- Eligible account: Money Market Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Branch Locator)

- Credit Inquiry: Soft Pull

- Direct Deposit Required: No

- Monthly Fees: None

- How to earn it:

- Open a new Regions promotional Premium Money Market account by April 30, 2023.

- Deposit at least $25,000 in new-to-Regions funds in your promotional Premium Money Market account within 15 days of account opening. Deposits must be new to Regions and may not be transferred from other existing Regions accounts.

- After the 15 day funding period, maintain a qualifying Average Daily Balance2 in your new promotional money market account for at least 60 consecutive days. See the table below for bonus tiers.

- Bonus will be deposited directly to your new Regions promotional Premium Money Market account within 60 days of completing the above requirements.

| CIT Bank Platinum Savings (4.00% APY). | Discover® Online Savings (Up to $200 Bonus + 3.70% APY) |

| SoFi Checking & Savings ($325 Bonus + 3.80% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| Live Oak Bank Savings (4.10% APY) | |

Fine Print

- One bonus offer is available only to you (the individual identified in this email or an individual in your household), is nontransferable and may not be combined with any other offer.

- To be eligible, the contact information used to open your new account must match Regions’ records (such as name, physical address or email address).

- When the credit is issued, new account must be open and have a positive balance.

- Regions may report bonus value to the IRS as required by law; anyone whose tax status would require Regions to impose tax withholding is not eligible.

- Regions associates are not eligible.

How To Waive Monthly Fees

- LifeGreen Student Checking: None

- Savings for Minors: None

- Now Savings: None

- LifeGreen Checking: $8 with online statements or $11 with paper statements (without check images). Avoid fees with:

- $1,500 average monthly balance in your LifeGreen Checking account

- ACH direct deposit, such as a recurring payroll or government benefit deposit, of at least $500 single deposit or $1,000 combined deposit, to your LifeGreen Checking account

- LifeGreen eAccess Checking: $8 monthly fee. Waive the monthly fee with any combination of at least 10 Regions CheckCard and/or credit card purchases

- 62+ LifeGreen Checking: $8 with online statements or $11 with paper statements (without check images). Avoid fees with any of the following:

- $1,500 average monthly balance in your 62+ LifeGreen Checking account

- ACH direct deposit, such as a recurring payroll or government benefit deposit, to your 62+ LifeGreen Checking account (at least one of $300 or more, or a combined amount of $1,000)

- LifeGreen Preferred Checking: $18 monthly fee. Avoid fees with any of the following:

- $5,000 average monthly statement balance in LifeGreen Preferred Checking account

- $25,000 combined minimum deposit balances from all of your Regions checking, savings, money markets, CDs and IRAs

- Have certain qualifying first-lien home mortgage loans in good standing

- Combined $25,000 minimum outstanding loan balances from all of your Regions personal installment loans, lines of credit, equity lines of credit, equity loans, direct loans and credit cards in good standing

- Regions LifeGreen Savings: No monthly fee if you have a Regions checking account

- Regions Savings: $5 monthly fee. Maintain a $300 minimum daily balance to avoid the monthly account fee

- Regions Money Market: $12 monthly fee. Maintain a $2,500 minimum daily balance to avoid the monthly account fee

- Premium Money Market: $15 monthly fee. Maintain a $15,000 minimum daily balance or open and maintain a LifeGreen Preferred Checking account to avoid the monthly account fee

- LifeGreen Business Simple Checking: $7 monthly fee. Waive the monthly fee by generating at least $500 in Regions Business CheckCard and/or Business Credit Card purchases

- Advantage Business Checking: $25 monthly fee.Avoid fees with any of the following:

- Maintain an average monthly balance of $10,000

- Combined balances of $30,000 in related non-personal accounts

- At least $2,500 in Regions Business Visa CheckCard and/or Business Credit Card purchases

- At least one Regions Merchant Services transaction credited to this account

- At least one deposit to this account using Regions Quick Deposit

- Business Interest Checking: $15 monthly fee. Maintain a $5,000 minimum average balance to avoid the monthly account fee

- LifeGreen Business Checking: $12 monthly fee. Avoid fees with any of the following:

- Maintain an average monthly statement balance of $2,500

- At least $1,000 in Regions Business Visa CheckCard and/or Visa purchases

- One or more Merchant Services transactions.

|

|

Conclusion

If you live near a Regions Bank location, check out why so many banking customers are satisfied with their banking experience with generous bonuses & offers. Right now, they have a $150 business referral bonus, as well as a $50 referral. It is very easy to get a referral link! Just follow the steps above and send the email to [email protected].

While these bank promotions are rather attractive, you can also take advantage of our list of Savings, Money Market, and CD rates.

However, if you do not live near a Regions Bank, definitely take a look at our bank bonuses page to find other offers. Some popular bank offers include Chase Bank, Discover Bank, TD Bank, Huntington Bank, HSBC Bank and many more.

Check back often for more Regions Bank Bonuses, Promotions, or Offers!

I’m wanting to take advantage of the $200 bonus for new LifeGreen checking which expires tomorrow, Dec. 29th,2017…Do you know if the referral bonus can be had in addition to that opening bonus? If so, I can send you the info you’ll need to refer me. Apparently you have to fill something out online first.

You just need to provide your details in the referral link I provided above. Once done you will get a confirmation email. You then need to sign up for an account using the same email. Once conditions are met you will get the bonus in your account and in few days you will get a $50 gift card for using the referral.