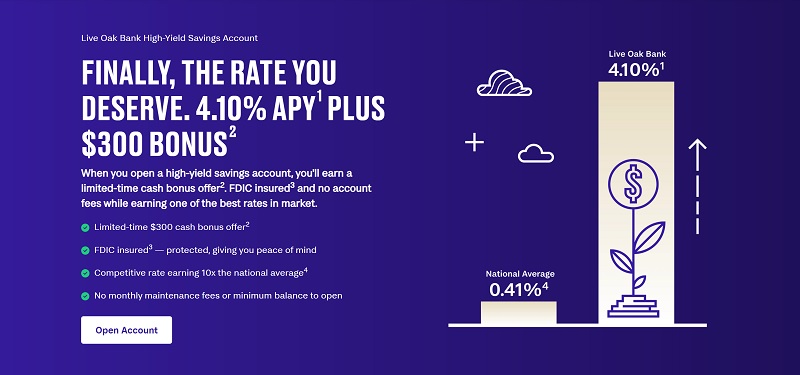

Available nationwide, Live Oak Bank Savings is offering a $300 bonus + 4.10% APY Rate. Definitely continue reading below for everything you would need to know about the attractive account and rate!

Update 5/14/25: Offer ends soon! The $300 bonus offer is back through 5/16/25! You’ll also earn a competitive interest rate on your funds! The rate has decreased to 4.10% APY from 4.20%.

Live Oak Bank $300 Savings Bonus

Earn $300 plus 4.10% APY with a Live Oak Bank personal savings account.

The perks of saving:

- Keep More of Your Money. Benefit from no monthly maintenance fees, and watch your money grow faster with a competitive savings rate.

- Peace of Mind. Your deposits are FDIC-insured3 up to the maximum allowed by law, ensuring your money is safe and secure.

- Personalized Service, Online Convenience. Open and manage your account online. Need help? Our North-Carolina-based team is just a call away.

- You Can Start Small. There are no minimum balance requirements, so you can start growing your savings no matter how small your initial deposit.

- Plan for the Future. Easily manage beneficiaries online to ensure your savings are passed on according to your wishes.

How to earn bonus:

- Open a New Account. Open a Live Oak Bank personal savings account by 5/16/25.

- Fund Your Account. Deposit at least $20,000 into your account by 5/16/25.

- Maintain Your Balance. Maintain a balance of at least $20,000 for 60 days.

- If all eligibility criteria are met, the $300 cash bonus will be deposited to your open, eligible account within 45 days following the expiration of the 60-day period.

- All funding of the new personal savings account must consist of funds originating from an external financial institution to qualify

(FDIC Insured)

Live Oak Bank Savings Review

Live Oak Bank, was founded in 2008 and offers savings rates that are many times the national average, and they boast an A+ health rating.

This FDIC-insured savings account makes it easier to grow your money with a great interest rate and simple online banking

I’ll review Live Oak Bank High Yield Online Savings below.

Live Oak Bank Savings Rate

- What you’ll get: 4.10% APY

- Eligible account: Savings

- Credit Inquiry: Soft Pull

- Where it’s available: Nationwide

- Opening Deposit: None

- Monthly fee: None

- Early Termination Fee: None listed, check with CSR

(FDIC Insured)

How to Earn Live Oak Bank Rate

- Visit the Live Oak Bank page and select “Open An Account Today” Tab

- Enter your full name and email address then check your email for an activation link and instructions on how to access Live Oak Portal

- Log in to the Live Oak Portal to open your account. Be sure to have the following info handy as they may ask for it: Name, Address, Social Security Number, Date of Birth and Funding Account Information

- Once your account is funded, enjoy earning 4.10% APY Rate

Live Oak Bank Account Features

- No Monthly Fees

- No Direct Deposit Required

- FDIC Insurance Up to Maximum Allowed by Law

- Interest Compounded Daily

Is This Account FDIC Insured?

Yes, your funds deposited with Live Oak Bank are insured up to the maximum allowed by law, which is currently $250,000.

|

|

Conclusion

Live Oak Bank is offering a great APY Rate for its Online Savings Account. Check out the link above for more information on the account.

They even compare this rate to other notable bank names. Check out more Savings Rates here on BCS so you can find an account that fits your needs.

In addition to the rate from Live Oak Bank, check out our list of best rates Savings, Money Market, and CD accounts.

If you are interested in expanding your financial future, definitely use our bank bonuses page to find other offers.

Some popular bank offers include U.S. Bank, Chase Bank, Discover Bank, TD Bank, Huntington Bank, Bank of America, Fifth Third Bank, and many more.

Let us know about your experience with this bank and comment below.

Check back often to see the latest info on Live Oak Bank Savings Account and our other Live Oak Bank bonuses.